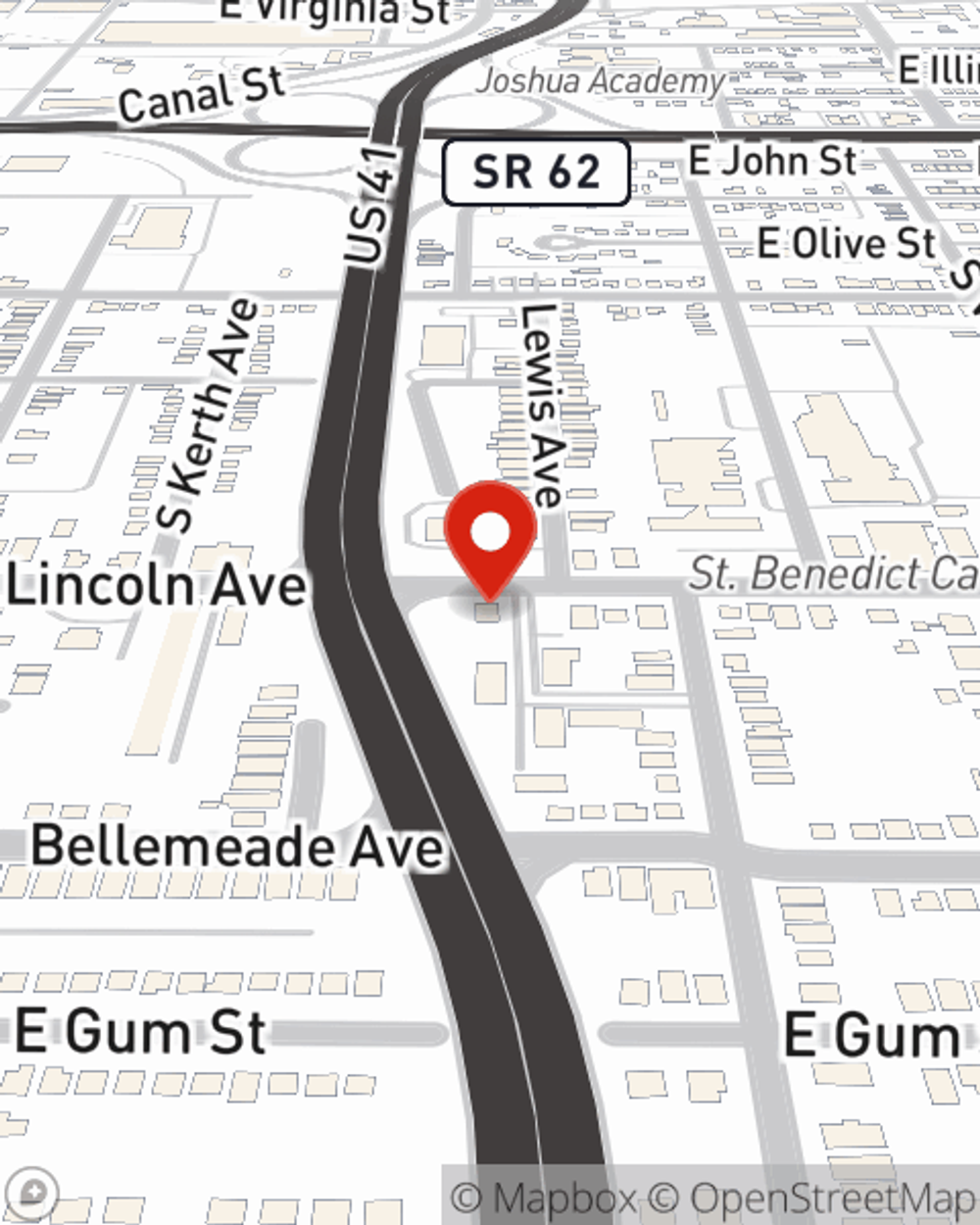

Condo Insurance in and around Evansville

Townhome owners of Evansville, State Farm has you covered.

Cover your home, wisely

Your Belongings Need Insurance—and So Does Your Condominium.

Often, your haven is where you are most able to catch your breath and enjoy your favorite people. That's one reason why your condo means so much to you.

Townhome owners of Evansville, State Farm has you covered.

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

You want to protect that special place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as lightning, fire or wind. Agent Bob Davis can help you figure out how much of this awesome coverage you need and create a policy that works for you.

When your Evansville, IN, condominium is insured by State Farm, even if the worst comes to pass, State Farm can help insure your property! Call or go online today and see how State Farm agent Bob Davis can help you protect your condo.

Have More Questions About Condo Unitowners Insurance?

Call Bob at (812) 491-7888 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.